Overview

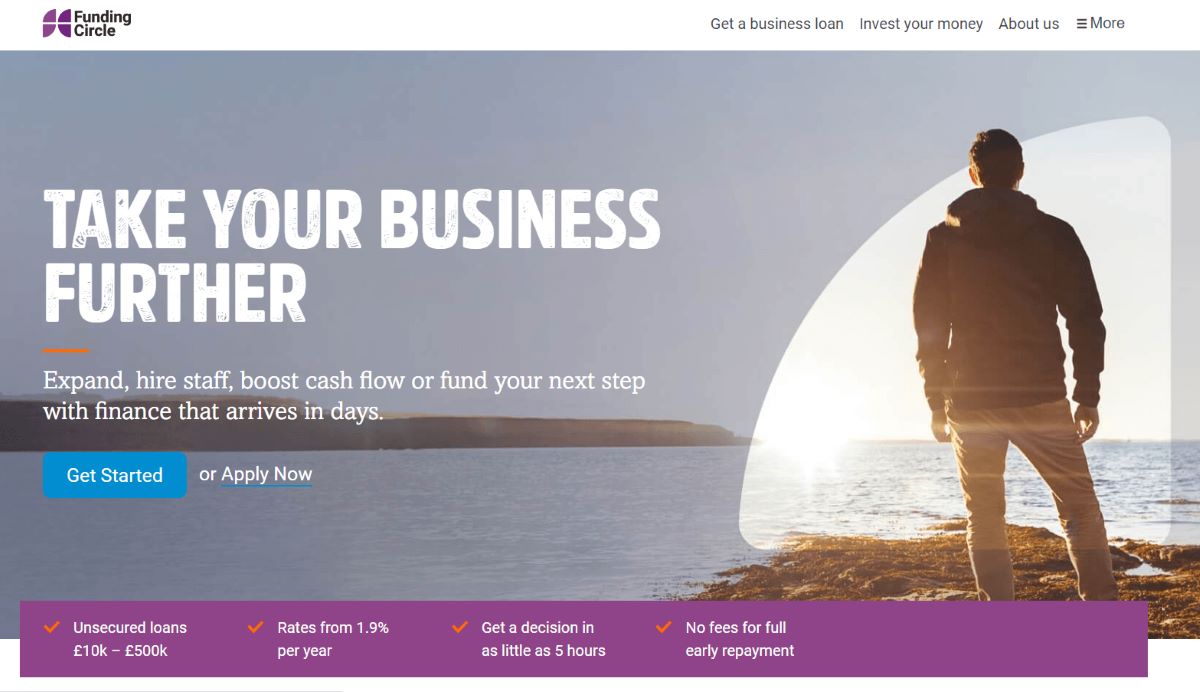

Only a few years ago, small business owners in need of a loan had few places to turn. They could try the Small Business Administration, but strict requirements left many businesses unfunded. They could try credit unions, but they also weren’t too free-handed with their loan approvals. Now, with the advent and growing popularity of peer-to-peer lending, one more avenue for small business funding has been opened. A leading lender in this somewhat new arena is Funding Circle, a peer-to-peer lender which has been in operation since 2010 and is headquartered in London. Besides the United Kingdom, the company operates in the United States (with a secondary headquarters in Denver, Colorado), as well as the Netherlands and Germany; to date, they have provided more than $7.8 billion in funding to 56,000 small businesses across the world.

Unlike other alternative lenders which may offer a smorgasbord of loan types, Funding Circle only offers the standard term or installment loan. The minimum loan amount is $25,000 but they can fund as much as $500,000; repayment terms will vary depending on need and other criteria; in general, the repayment terms range from 12 months to five years. Term loans are amortized, meaning that the borrower will pay more interest early on and less as the loan winds down.

As mentioned, Funding Circle is a peer-to-peer

Lender. In other words, once your application for a loan has been submitted and vetted, they submit your loan to the “marketplace,” where they match your business with potential lenders. Which lenders they attract will depend on certain criteria that reflects your company’s credit worthiness; for example, a more conservative lender looking for a sound investment might only be willing to invest in you if your credit profile and business acumen reflects his or her strict requirements. On the other hand, a lender looking for a larger profit might be willing to invest in your business even if it’s a bigger risk, and they’ll charge you more interest as a result. Rest assured, Funding Circle’s underwriting process will not have vetted you at all if they didn’t believe there was a market match.

According to the Senior Underwriting Manager at Funding Circle, because there is a ripple effect on a default which could effectively dampen enthusiasm for the whole peer-to-peer lending scheme, the company is very mindful of the possible outcomes, both from a borrower and investor point of view, which makes them much more circumspect in the decision-making process. Funding Circle has a specific formula by which they gauge a company’s creditworthiness. That formula is the business owner’s personal income plus business income (EBITDA – earnings before income tax, depreciation and amortization) divided by the total of personal debt plus business debt.

- Can offer funding of up to $500,000

- Borrowers who have filed for personal bankruptcy are not immediately excluded (but T&Cs apply)

- No requirement for minimum annual revenue

- Funding Circle does not have a minimum debt coverage ratio that is required

- Application process takes as little as 10 minutes

- Your credit history with Funding Circle is not reported to the credit bureaus

- The loan review process is relatively quick compared to traditional lenders, with funding available in as few as 10 days after application

- Annual Percentage Rates or APRs for Funding Circle loans varies from a low of 5.5% to a high of 35.5

- Repayment amounts are fixed and repaid monthly so there are no surprises

- No prepayment penalties

- Funding Circle is sometimes willing to take a 2nd lien position behind another lender

- Borrower must have a personal credit score of 620 (minimum)

- Business must have been in operation for a minimum of two years

- Many industries and types of businesses are excluded, including sole proprietorships, aviation, investment firms, real estate development, guns and ammo dealers, adult entertainment, general contractors (including plumbers and HVAC), truckers

- Some restrictions on fund uses apply

- Late payment fees are equivalent to 5% of amount due, which could be substantial

Services Offered & Types of Funding

Funding Circle offers only small business installment (term) loans, with a repayment term from 6 months to 5 years. The company has very few restrictions on the uses of the funds. They stress that it is generally a viable option for a business owner who is looking to consolidate existing business debt, especially if that is a result of credit card debt or short-term debt. But a consolidation loan isn’t the only use of funds they suggest; they can also fund inventory and equipment purchases, new hiring, expansion of your space to a new location, and marketing expenses. Are there exceptions to their use of funds? Yes; they do not permit funds for the purchase of titled assets nor can a loan be funded to consolidate personal debt or for personal finances.

Rates and Fees

| Types of Loans | Minimum Loan Amount |

Maximum Loan Amount |

Interest Rate | Origination Fee | Repayment Terms | Collateral Required |

|---|---|---|---|---|---|---|

| Working Capital Loan | $5,000 | $250,000 | Factor rate; ranging from 1.15x to 1.49x | 2.5% | 6 to 17 monthsPaid Daily or Weekly | UCC-1 Lien for loans over $100,000Personal Guaranty |

| Business Expansion Loan | $10,000 | $250,000 | Fixed APR; ranging from 7.4% to 36% | 2.5% | Up to 24 monthsPaid Weekly | UCC-1 Lien for loans over $100,000Personal Guaranty |

| Merchant Cash Advance | $10,000 | $100,000 | Factor rate; ranging from 1.11x to 1.49x | None | 3 to 14 monthsPaid Daily or Weekly | Not required |

Funding Circle says that the origination fee rate determinant is based upon the strength of the borrower’s credit profile. The amount is deducted from the loan proceeds. It is a one-time fee and covers Funding Circle’s costs for the evaluation and origination of your loan. Funding Circle’s origination fees are, from what we found in our Funding Circle review, among the highest in the industry.

Borrower Qualifications

From the start of this Funding Circle review it was obvious that Funding Circle’s borrower qualifications are probably among the most stringent in the alternative lending space. For example, they won’t fund a start-up business, nor will they fund a business that has not been in operation for at least two years. A low income stream or revenue projection is also probably a deal breaker for Funding Circle lenders. It should be noted that companies in Nevada are not eligible for loans from Funding Circle.

Though the company takes an overall holistic view during their underwriting process, looking at not just the personal and business credit background, they will also look at personal and business income and expenses and they will also look at online reviews to gauge the company’s online profile. Funding Circle will want you, as the business owner, to have a personal credit score of at least 620. If you have had a personal bankruptcy in your past financial and credit history, it will have had to have been discharged at least seven years ago. Moreover, tax liens must have been fully repaid and cannot have been filed within the past 10 years.

Who is Funding Circle’s typical borrower? According to their website, their “average borrower” has a typical credit score of 700. He or she owns business which as fewer than a dozen employees (the average is 10) and which has been in business for nearly a decade. The annual income for this “average borrower” is about $2 million. According to the Funding Circle founder, an established business is preferred because they typically have sufficient cash flow and growth projections necessary to repay the loan.

Some might argue that if a borrower is able to meet Funding Circle’s stringent loan criteria, why not just apply for an SBA loan? While that is an undeniable argument, Funding Circle’s ability to fund at a significantly more rapid pace than the SBA makes this an attractive yet viable option for a small business owner.

Funding Circle will file a UCC-1 lien against the company assets. The secured collateral is typically accounts receivable, inventory, equipment and vehicles, etc. The primary business owner (i.e. the individual(s) who owns more than 20% of the company) will also be required to provide a personal guaranty of the debt.

Application Process

The application process is relatively painless. The process begins with a 10-minute online application followed up (within an hour) with contact from their personal loan specialist who will assist you with the process of collecting documentation and to answer any questions you might have. The underwriting and decision-making process can take as little as 24 hours, according to their website, but it typically averages about five days from start to finish (funding).

The documents and criteria generally required to be submitted include the following:

- P&L (profit and loss) statement for the most recent tax year

- Balance sheet for the most recent tax year

- Business bank statements (minimum six months)

- Business federal tax returns (for last two tax years)

- Personal federal tax return (for most recent tax year)

- Business schedule of debt

- While Funding Circle says they do not require a minimum coverage ratio they do acknowledge that they prefer the debt service coverage to be above 1x. The debt service coverage ratio (or DSCR) is generally calculated by dividing a company’s net operating income (on an annual basis) by its debt payments (again, on an annual basis). A DSCR higher than 1x is an indication that income can sufficiently cover loan payments (both principal and interest).

- The company is also required to have a business checking account.

- Loan payments are automatically deducted one month after the loan is funded; a fee of $35 will be assessed if the payment fails due to insufficient funds.

Help & Support

Most borrowers will want to have a solid guesstimate of how much a loan is going to cost them, given possible interest rates and origination fees. Fortunately, an interactive calculator on the Funding Circle website makes short shrift of that question.

From the beginning of the process, you will be provided with both phone and email support via a designated account manager. Any questions about your loan or about the application process can be directed to this individual. The process of renewing your loan (after the first six months) can also be handled by your dedicated account manager. More generalized information can be accessed via the company website or the downloadable brochure which provides an overview of Funding Circle’s capabilities and services.

Funding Circle has a philosophy: They believe that every small business, as the growth engine of the economy, deserves better. Funding Circle was built with that premise in mind; small business owners deserve an efficient yet transparent way to satisfy their growing needs for capital, while ensuring that the total cost of the loan was fully understood.

User Reviews

Funding Circle is accredited with the Better Business Bureau and gets an A+ rating from them. During this Funding Circle review we read dozens (if not hundreds of user reviews about the company). On reviewing websites, generally, Funding Circle gets above average reviews from its users, both from a borrower’s and an investor’s perspective (remember, as a peer-to-peer lender Funding Circle must take into consideration both sides of the proverbial coin). On the website Trust Pilot, Funding Circle had nearly 5,000 reviews, with 86% of those giving it an “excellent” rating. The compliments for the company are primarily based on the good customer service, the ease of the application process and the ability to receive funds quickly.

Where there were complaints, it was for the high interest rates, the frequency of sales calls and the lengthy application process. The fact that Funding Circle only lends to established small businesses also resulted in a number of complaints.

Final Thoughts

For a small business which is already well established and profitable, Funding Circle is a viable choice among alternative lending sources. In general, the creditworthiness of the borrower and business will need to be on par with the more typical lenders and the SBA. While interest rates are likely to be higher with Funding Circle than with the average financial institution, the process and speed of funding can make this a more attractive proposition. As the saying goes, time is money, and waiting for funds to satisfy an immediate need can mean an opportunity lost.

Is Funding Circle the best fit for your business? It may depend upon your needs. But, if you do happen to fall into the category that this company caters to (i.e. well established and profitable), then there are a number of other reputable alternative lenders with better rates which could also serve you well. You will have to do your homework to gauge which is the best fit for you but certainly, you should not dismiss Funding Circle as a strong contender.