Overview

Founded in 2007, OnDeck has become one of the most prolific loan providers on the market, and has funded over $10 billion in loans since its launch. Compared to traditional bank loans, OnDeck’s eligibility requirements are very relaxed, and the company focuses more on business performance rather than personal credit history. While this is great if you need to secure a loan fast, keep in mind that loose borrower qualifications and fast funding usually go hand in hand with higher fees. Therefore, it is always a good idea to compare a few lenders before deciding on the loan that works best for you.

- Quick, automated application process

- Funding usually granted within 48 hours

- Very relaxed eligibility requirements

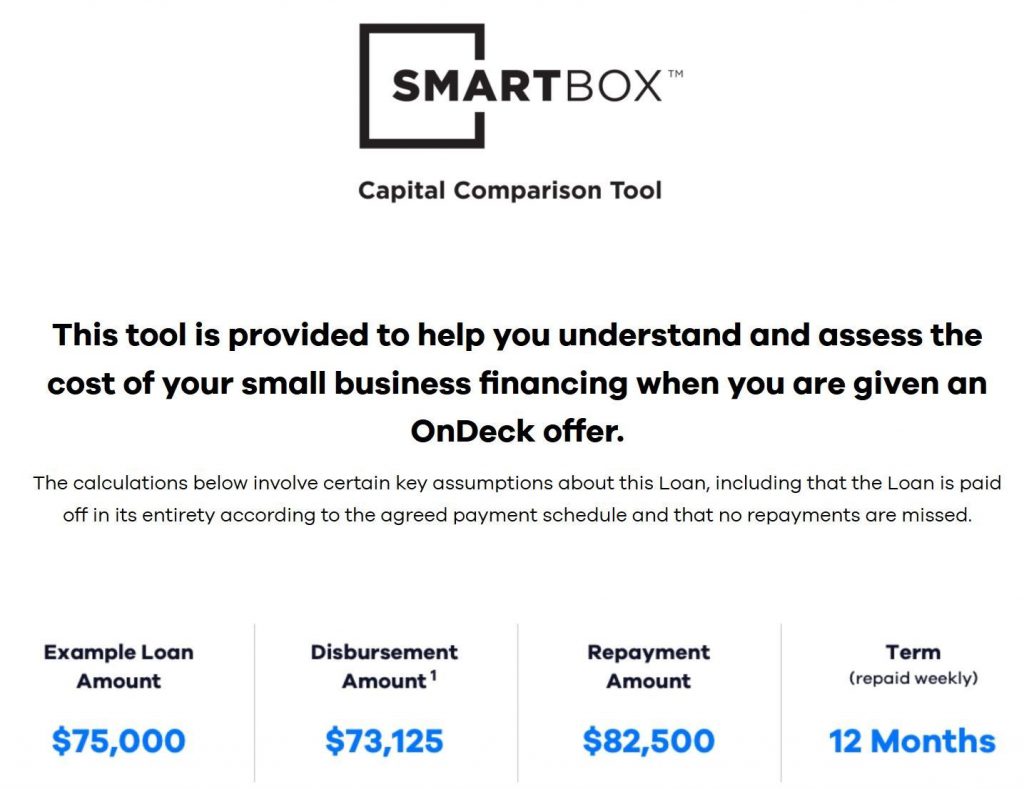

- SMART Box: online tool that specifies all costs before you accept a loan

- Application process does not affect your credit score

- Transparent website using clear, straightforward language

- Rates can be quite expensive depending on your qualifications

- High weekly payments may be difficult to pay if your small business has irregular cash flow

- Website lacks information on exact fees

- Some clients complain about junk emails

Services Offered & Types of Funding

OnDeck offers term loans as well as lines of credit. It prides itself in having issued over 80,000 loans and lines of credit to small businesses since its launch, which is indeed impressive.

OnDeck’s short-term loans range from 3-12 month terms and are ideal for small business owners looking for ways to finance short-term projects or who need to bridge a gap in cash flow, for instance.

The long-term loans range from 15-36 month terms and are more suited for the funding of bigger projects that pay back longer term, like expanding a small business or investing in new equipment. Whether you choose a short-term or a long-term small business loan, the amount you can borrow ranges from $5,000 to $500,000.

OnDeck’s line of credit offerings can be a good option for small business owners looking for a more flexible loan. Draw only the amounts you need whenever you need them and only pay interest on the actual amounts you have withdrawn. The available loan amounts for lines of credit are $6,000 – $100,000.

-

- Type of funding term loans and lines of credit

- Minimum time in business 1 year

- Loan amount $5,000 – $500,000

- Age of business 1+ year

- Minimum credit score 600

- Time until funding 24-48 hours

- Repayment terms 3-36 months

Rates and Fees

OnDeck’s short-term loans allow you to choose repayment terms between 3-12 months with a maximum loan amount of $500,000. The Simple Interest (i.e. the non-annualized interest rate given as percentage of the amount borrowed) for these loans is as low as 9%, which is decent compared to other lenders. However, please note that the lowest rates are only available to businesses with strong credit history and healthy cash flows. If you do qualify for the lowest Simple Interest of 9%, your interest cost will be $900 on a loan of $10,000. With a repayment term of 6 months and weekly payments, your total payback amount will be $10,900. It’s a good idea to do some quick math to see if you can afford the repayment schedule before applying for a loan. If you’re not sure what exact interest rate you’ll qualify for, crunch a few numbesr to make sure you’ll be able to clear the payments even if you don’t qualify for the lowest possible interest rate.

Long-term loans for the funding of larger projects over a longer period of time allow you to choose terms between 15-36 months, the maximum loan amount being $500,000, as above. The lowest Annual Interest Rate for this type of loan is 9.99%. If your business is strong enough to qualify for the lowest interest rate, a 24 month, $100,000 loan with weekly payments will cost you $10,418.15, for a total loan payback amount of $110,418.15.

OnDeck’s line of credit offerings could be a good option of you are looking for more flexibility. Draw only the amounts you need whenever you need them and only pay interest on the actual amounts you have withdrawn. The minimum APR as advertised on OnDeck’s website is 13.99% and is available for small businesses with excellent credit scores and cash flows. However, note that the weighted average rate for lines of credit is currently at 32.6%.

Let us look at an example. Based on an APR of 19.99%, a $10,000 line of credit will amount to a total repayment of $10,149.74 if paid off within 1 month. The same line of credit amount paid back within 12 months will result in a total repayment of $11,051.92.

OnDeck will charge a $20 monthly maintenance fee for your line of credit. However, this fee is waived for 6 months if you draw $5,000 or more in the first five days after opening your account. Drawing money does not involve extra fees.

1st loan: 2.5-4% of loan amount

2nd loan: 1.25-3% of loan amount

3rd+ loan: 0-3% of loan amount

Borrower Qualifications

OnDeck’s eligibility requirements are among the most relaxed you will find. The minimum age of your company is 1 year, whereas with many other lenders it often is 2 years. On their website, however, OnDeck states that the median time in business for their clients is 7 years. Your minimum personal credit score must exceed 500 for term loans, with most of OnDeck’s clients having a credit score of 660 or higher. You will need a minimum of $100,000 in annual revenue for term loans and lines of credit and are required not to have experienced bankruptcies in the past two years. Also, you need to make at least 5 deposits to your business checking each month.

Applying for both term loans as well as lines of credit will require you to sign a personal guarantee. However, unlike with term loans, you will not need a lien on your business’s assets for OnDeck’s lines of credit.

Despite OnDeck’s relxed borrower qualifications, note that just like with other lenders, certain industries are not eligible for a small business loan with OnDeck. These types of businesses include lotteries, casinos, and companies that deal with religion or politics.

Application Process

Unlike with traditional loans, the loan offerings OnDeck offers involve a minimal amount of paperwork, which makes the application process exceptionally quick. To apply, simply fill out an online questionnaire or call the help line if you prefer to talk to an OnDeck representative. Whether applying online or via phone, your eligibility can be assessed within 10 minutes. Once you have been approved, an OnDeck representative will get in touch with you and guide you through the rest of the process and answer any question that may arise. Before you sign a contract with OnDeck, you will get a fully detailed overview of the exact cost of your loan, courtesy of the company’s proprietary SMART Box tool

After signing the contract, funds can be transferred to you within a day or two. For a seamless application, make sure you have the following information ready, as stated on OnDeck’s website:

- Your business Tax ID number (EIN)

- Your Social Security number

- Estimated annual gross revenue

- Average bank balance

- Last 3 months of your business bank statements

Help & Support

OnDeck’s customer support is generally considered competent and professional. The company pairs each client with a personal account manager who helps with the application process and is available at every stage of the loan period. Clients often mention the benefit of having a personal representative accompanying them all throughout the loan process, making it a more personal experience. The support team can be reached via live chat, email, or phone, as well as via Facebook and Twitter.

OnDeck’s website is clear and intentionally written in a simple language which is great for business owners who aren’t familiar with financial processes. Another positive feature of the website is the collection of helpful articles on topics revolving around small businesses, which you can find in the “Resources” section.

User Reviews

User reviews often mention the professionalism and competence of OnDeck’s sales representatives. Customers also value the quick application process which can result in very fast funding.

Negative reviews mention aggressive sales practices and the company’s relatively high rates. Some small business owners also complain about the high daily/weekly payments.

Final Thoughts

OnDeck is no doubt an established and successful lender with a large number of clients. For all those small business owners who have a hard time qualifying for low cost loans with other lenders, OnDeck may present a great opportunity to secure funding quickly. The company’s practices are fairly transparent, though their website could contain more detailed information with more concrete numbers. However, before accepting a loan and signing a contract, you will get a detailed overview of all the costs involved, so that you will not encounter any hidden fees if you read carefully.