Overview

Torro is a business loan provider that is dedicated to solving cash flow and working capital needs for small businesses and entrepreneurs. Founded in 2012, Torro has grown to specialize in small business, new business, and even startup loans, catering to the needs of individuals hoping to jumpstart and expand their businesses. Torro specializes in connecting small business owners with their network of private investors, independent brokerages, and lenders. The company prides itself on granting fast approvals for all types of business loans (with funding approval given in as little as one hour), as well as reliable service. In addition to loans, Torro also offers consultations for small businesses and startups.

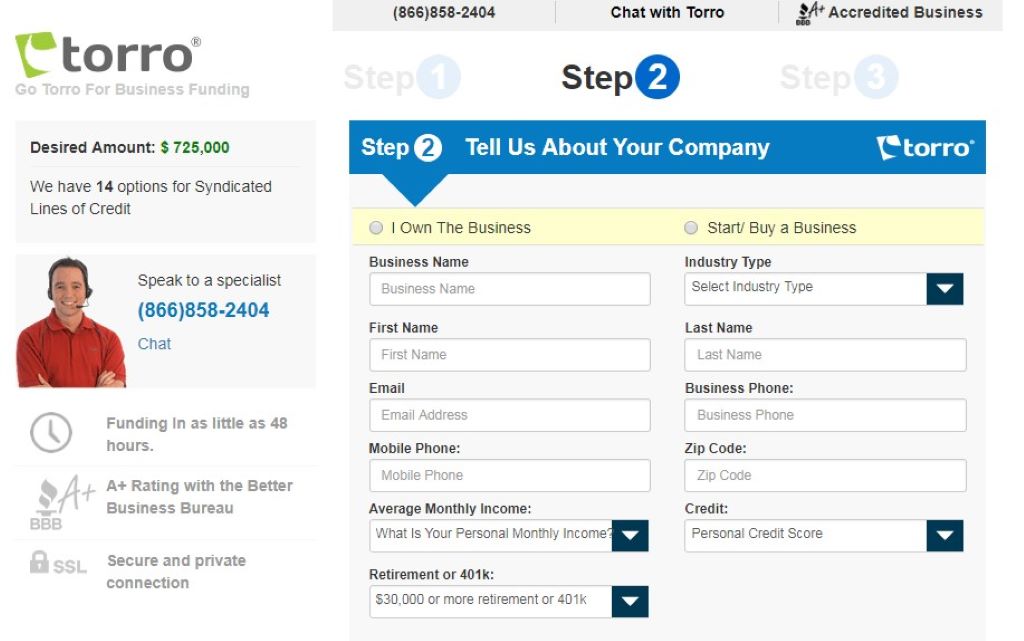

With one click and a few form fields between you and a list of potential lenders, the application process is simple. Once your application has been submitted, they search a wide network of providers to find funding for your business needs. Torro’s loan matching process makes it easy to find the funding your company needs. Approval is fast, and funding is usually received within 48 hours. In over 6 years of business, Torro has served as a reliable small business lending platform and became a Better Business Bureau accredited business on October 23rd, 2015.

- Easy online application

- Offers bad credit business loans

- No collateral required

- Fast approval and funding

- Funding for startups and high-risk

- Available in all 50 states

- Young company

- Limited information on the website

- Limited support

Services Offered & Types of Funding

- Type of funding – Line of credit / Merchant Cash Advance

- Age of business / Minimum time in business – Funding for Startups and Existing Businesses

- Loan amount – $5,000 – $575,000

- Minimum credit score – None

- Time until funding – as little as 24 hours

- Repayment terms – 12-48 months

With hundreds of funding solution options available not every business qualifies for each solution. Generally, most businesses only qualify for 1-3 funding programs and Torro has narrowed all funding options down to 2 easy categories.

New Businesses and Startup Loans

Of all the things starting a business demands, finding funding is certainly at the top of the list. There are dozens of types of loans and lenders in the market, and each will claim that they’re the best for you. With a quick 3-step process Torro can assist you and your startup in obtaining $25,000-$125,000 in unsecured working capital. This is ideal for entrepreneurs seeking startup funds and the approval is determined off the business owner, partners and investors personal credit.

Small Business Loans for Existing Businesses

Small-business loans are typically issued only for businesses with a year or more of history and revenue. Among the financing options for entrepreneurs who qualify for this type of loan Torro can setup merchant cash advances and lines of credit.

If you’re worried about whether you can get a business loan with bad credit, you should know that not all hope is lost. Torro provide loans to people with a poor business or personal credit score. Just keep in mind that your interest rate and other fees will go up depending on that company’s confidence in your credit.

Merchant Cash Advance

Merchant cash advance is one option for small business financing – if you have a business with outstanding invoices. With a merchant cash advance, you obtain funds by ‘selling’ your future credit and debit card receipts to Torro. Torro advances you a cash lump sum for these receipts and determines the amount you must pay back over time. In this case, Torro arranges with the credit/debit card companies to receive a fixed percentage of your daily receipts to pay back this amount. The actual time it takes to pay off your advance will depend upon the volume of credit/debit card proceeds coming in.

At Torro, they don’t restrict how you use your merchant funding. While your business may benefit from financing for new equipment, another business may need it for payroll. Torro provides the merchant funding, and you choose how to utilize it. You can utilize your merchant cash advance to fill inventory orders, upgrade equipment, expand your business, have cash for payroll, pay for marketing developments, invest in new technologies, recruit new employees and even start a renovation project.

Getting a merchant cash advance with Torro is fast and easy compared to traditional bank loans. To apply, just complete a few simple questions online or over the phone. Tell Torro about your business and your needs privately and confidentially. No collateral is required, and you can receive an approval, in most cases, on the same day!

You can get a Torro merchant cash advance for amounts ranging from $5000 to $750,000, and you can use it for all your financing needs.

Lines of Credit

Torro is a leading online lender that offers a variety of small business loan and line of credit options. You can apply for a business line of credit with Torro in less than 10 minutes.

Every small business experience cash flow challenges. Since cash flow fluctuations are a natural part of doing business, rather than trying to avoid them, an alternative approach would be to actively manage your cash flow by using a line of credit.

A line of credit is a given amount of money you can borrow when you need it and repay back when you don’t. It is different from a loan because you don’t have to use it, but you can use it as a buffer or a fallback option if you have unexpected cash flow issues brought about by late paying clients, unplanned for expenses, or simply by seasonal cycles. Line of credit funds may be borrowed, repaid, and borrowed again and can also be a great way to start building or bolstering your business credit score. Interest rates for line of credit tend to be a little bit lower as as well. Otherwise, the qualification process for Lines of Credit and MCA’s are the same.

Borrower Qualifications

Torro doesn’t have a concrete list of basic requirements. The application process itself is composed of a short questionnaire that only takes a few minutes to complete. Each loan type has its own guidelines for qualification, and individual lenders often consider additional factors.

An existing business looking to qualify must:

- Be in good standing

- Have a valid tax ID number

- Have a valid business address and phone number

- Have a valid and verifiable U.S. bank account

- 3 to 36 months of personal bank statements may be required

- Must not reflect more than 6 credit inquiries within past 90 days

- Provide a verifiable business or personal credit history and may need to provide proof of properly files tax returns for past 2 to 5 years.

- May need to submit your previous four paycheck stubs. In order to qualify for a startup loan, you must: Be a legally-filed business entity in good standing

- Present a business plan and a statement of how funds will be used

- Provide personal tax returns for the previous two years or three to 36 months of personal bank statements

- Provide proof of income

- present past business references (landlords, employees, etc.)

In either case, collateral may be required if credit minimums are not met. Some lenders may ask for other documentation or proof of assets depending on the loan type for which you apply. A minimum credit score of 650 is required in certain cases, by certain lenders, which might be prohibitive for some startups or businesses with less than ideal credit, but other financial information may be accepted as an alternative.

Rates and Fees

Besides the interest rate charged for each loan, LoanMe has also has an origination fee, which is not uncommon for online lenders. That fee varies from as little as 5% to as much as 10% for most of the loans it offers. Regardless, there is a minimum origination fee of $500 for any loan from LoanMe. For prime loan packages for California borrowers, the origination fee is a flat 15% of the loan amount. That fee is deducted from the loan proceeds, so the amount disbursed to you will be the loan amount minus the origination fee costs. LoanMe does not charge a fee for early payment of the loan, whether in part or in full. As is typical of the industry, a late fee will be assessed if payments are late by a specific number of days as stated in the contract. LoanMe encourages its borrowers to reach out to them early on in the process if they know there will be a problem with a future payment

Application Process

Torro offers a quick application process that can see customers getting funded within 2 days. This is pretty much standard among online, alternative lenders. To apply for funding from Torro, click the “Claim Your Funding Now” button on any page of the site, choose the desired loan type, and enter some basic information:

- Business name and industry

- First and last name

- Email address

- Business and mobile phone ZIP code

- Length of time in business

- Average monthly income

- Monthly credit card sales volume if applicable

- Credit score

- Whether

After Torro receives the information they need to match your file to the best funding program available, underwriting generally happens on the same day. Within just a few short hours you will have an offer on your file and Torro will connect you with a financial product that’s right for you. Once approved you will be able to access the capital in as little as 24 hours!

Torro uses TrustGuard along with SSL technology and PCI scanning to encrypt all customer information before transmission. Confidentiality is required from all their employees and third-party lending affiliates with whom your information must be shared over the course of the funding process. Complete security and privacy details are laid out in Torro’s privacy policy.

Help & Support

Torro business funding is not a bank but an alternative solution focused on solving cash flow and working capital needs for small businesses. By engaging with torro you can be assured that your team of funding specialist working your account will narrow down the right funding solution for your business.

If you have questions about any part of the application or lending process, help is available via phone Monday through Friday from 8 am to 5 pm PST. Customers can also get in touch with Torro by live chat or email. Live chat on their website site can provide immediate help when you’re in need of quick answers before applying or while you’re filling out an application. If a staff member is not available by live chat, you can leave a message so that they can contact you later.

However, the site lacks a lot of detailed information provided by similar lenders. For instance, you won’t find a blog or an FAQ page. Still, their well-trained experienced team of advisors will help you and assist you throughout the entire process so perhaps those pages aren’t entirely necessary.

User Reviews

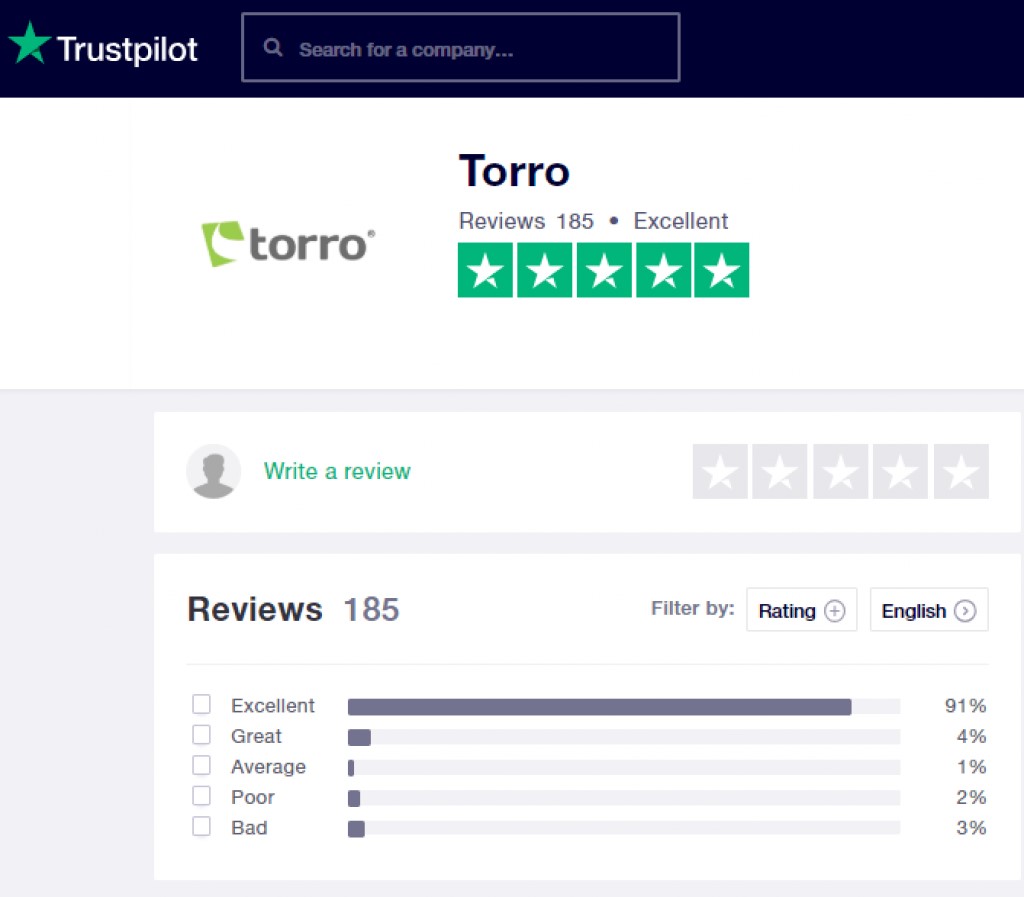

Compared to other lending platforms that tend to reflect an excessive volume of complaints, the majority of the feedback we found relating to Torro was positive.

Torro have 185 reviews on the website Trustpilot, with 91% of them giving Torro an “excellent” 5-star rating. Of the 5-star reviews, the claim was primarily due to ease of applying, smooth fast turn around and no hastle. Consumers write that the team explained almost everything they needed to know and they were able to get the business funded quickly. We further analyzed the 5 (out of 185) bad (one star) Torro reviews and it seems that the main concern is related to the high cost of the loan and that funding was quite expensive, but this shouldn’t come as a surprise to the loan taker.

Final Thoughts

As with many online loan matching services, Torro’s application process is simple. Torro asks for only a few pieces of personal and business information, and applications may be approved in under an hour.

The company may prove to be an exceptionally good option for those seeking loan services for startups and new businesses. Operating as one of the best small business lending networks, Torro offers some of the lowest APRs when compared to other online lending platforms and offers superior customer service. if you are having a difficult time acquiring a small business loan, then we encourage you to check out Torro for your business needs.